Medicare Dental Life Insurance

Let's take care of it now,

not at the time of need.

Independent Medicare Insurance Agent in Tampa FL

Being an Independent Agent, my focus is to educate and assist individuals turning 65 to navigate through the Medicare process. Whether looking for Medicare Supplements, Prescription Drug Plans or choosing a Medicare Advantage Plan, my experience and education will help you to make the right choices for your needs.

Along with Medicare, my passion is to help families understand how important it is to have something in place to protect them from the financial loss of someone; Life Insurance, Final Expense, Prepaid Burial or Cremation.

These are the products I specialize in to eliminate the financial burden of losing a loved one. I am here to assist with the many questions that need to be answered, lets take care of it now and not at the time of need.

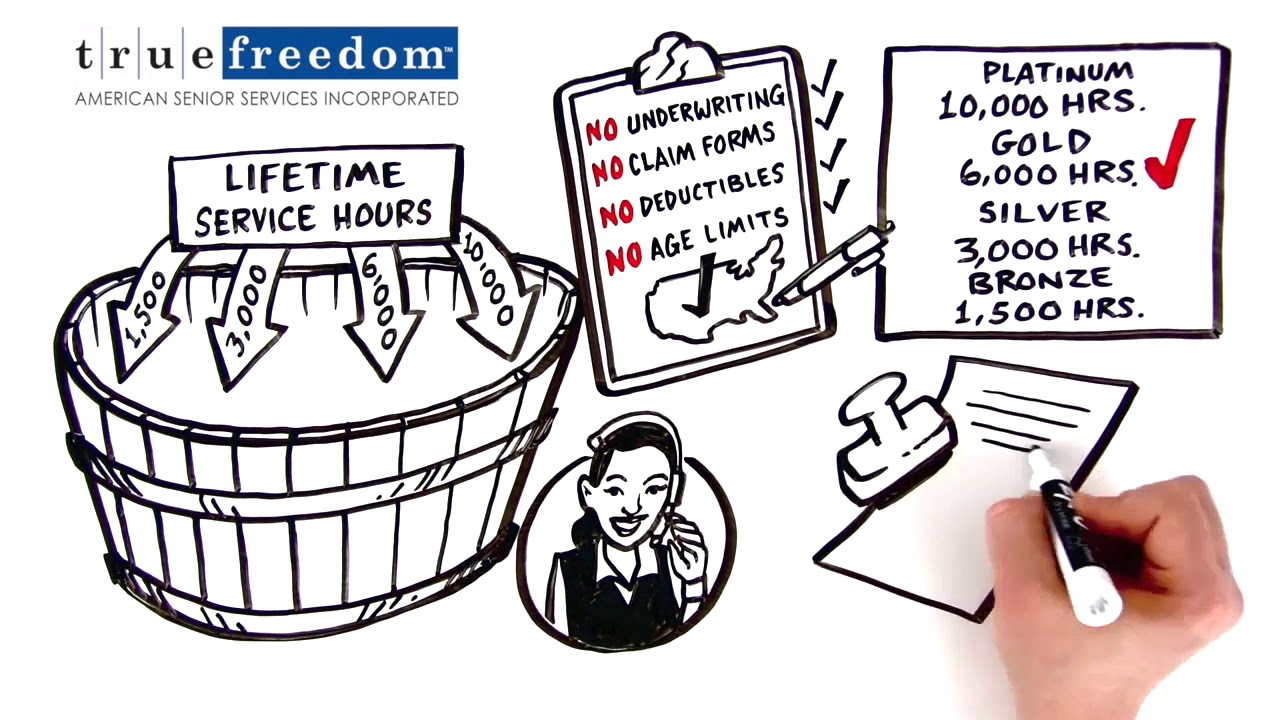

Learn how easy True Freedom Home Care Plans can help.

Let's take care of it now and not at the time of need.

What happens when I turn 65?

Close to 80 Million baby boomers turned 65 in January of 2011. Between 2011 and 2030 some 10,000 baby boomers are turning 65 everyday. If you are turning 65, it’s time to think about your Medicare options. Delaying your enrollment may result in penalties that you may have to pay the rest of your life.

Your Medicare enrollment period is 3-months before your birthday and continues for 7-months. If you are receiving your Social Security Benefits, you don’t need to do anything, Social Security will automatically enroll you in Part A (Hospital Stays) and Part B (Physician Fees) benefits effective the 1st day of your birthday month. You must purchase a prescription drug plan or could be subject to a fine.

Get your free consultation today

There are basically 3 options when turning 65:

Option 1: Straight Medicare – Includes Part A & Part B. For your Part B, you will pay a premium that can increase every year and is based on your income. In 2017, most people pay $134.00 / month. Also, the government says you must purchase a PDP (Prescription Drug Plan) and if you don’t, you could be fined. Straight Medicare is an 80/20 plan, so you are responsibile for 20% of an unknown number – Not a good Deal. Straight Medicare works for those with Medicaid because Medicaid picks up the 20%.

Option 2: Supplements or so called Medigap Policies – With the co-payments, deductibles and coverage exclusions, Straight Medicare may only pay for about half of your medical bills. By purchasing a Supplement Policy from a private insurance company, most of your out of pocket expenses can be covered. These policies can run anywhere from $50.00 / month to well over $200.00 / month. With a supplement, you must purchase a PDP plan to be compliant. As you can see, supplements are not for everyone due to the cost.

Option 3: Advantage Plans – These plans are also offered by private insurance companies. Called A Part C, Advantage Plans include Part A, Part B and Part D. In the state of Florida, many of these plans are 0 Premium. Advantage Plans are either HMO’s or PPO’s. With an HMO, a referral is required to see a specialist in most cases, where as with a PPO, no referral is required, but as with an HMO, you must stay in network with your doctors. Advantage Plans offer many benefits that Straight Medicare does not offer.